401k calculator with catch up contributions

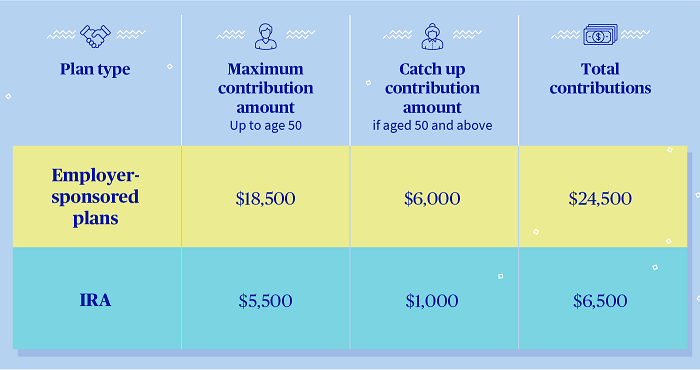

2022 Total Annual 401k Contribution Limits. The contribution limit for those 50 and older is 26000 which includes the catch-up contribution limit of 6500.

401k Catch Up Contributions Retirement Catch Up Limits

For 2022 workers with a 457b plan can contribute up to 20500 to their account through elective salary deferrals.

. You might also consider opening an individual retirement account IRA to further build your savings. For the tax year 2022 that limit stands at 61000 or 67500 when you. For 2022 the catch up contribution limits are as follows.

To be eligible to make 401k catch-up contributions your current employers plan has to offer catch-up. As of 2020 the 401k contribution limit for those aged 50 and below is 19500. For those ages 50 and older the catch-up contribution is capped at 6500.

And as an added bonus many employers will match your contributions at an average rate of 42. So if you contribute the annual limit of 20500 plus your catch-up contribution of 6500 thats a total of 27000 tax-advantaged dollars you could be saving towards your retirement. Your employer match contributions are taken into account for this overall contribution limit.

How to Work 401k Pre-tax Dollars to Your Advantage. However there is another limit that applies to overall contributions. For 2020 the maximum contribution amount is 19500 plus a 6500 catch-up contribution if the employee is age 50 or older.

Roth 401k contributions are made after taxes have been taken out of your paycheck. This hypothetical example assumes the following. Employers offer 403b and 401k plans to help their employees save for retirement but chances are you wont have to choose between them.

The maximum catch-up contribution available is 6500 for 2022. Dollar-for-dollar match up to 5. The 401k plan annual.

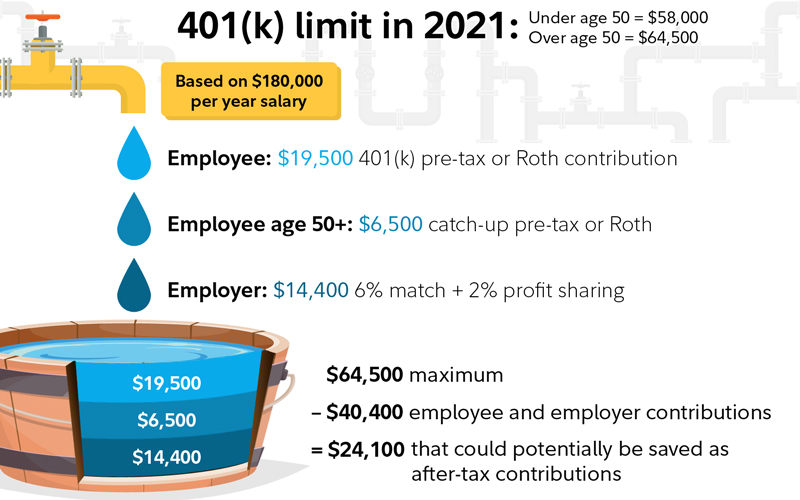

The maximum employee solo. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401k contribution limit is 57000 and the maximum 2021 solo 401k contribution is 58000. If you are age 50 and older and make catch-up contributions the limit is increased by these catch-ups to 64500 for 2021 and 67500 for 2022.

For governmental 457b plans only. A catch-up contribution of for if you are 50 or older. If you earn 50000 and you add your 5 to the plan thats 2500 youve put in.

While its nice to have dont count it toward your 15 goal. Catch Up 401k Contributions. For example many calculators include salary growth but fail to subtract for inflation.

For an individual account you can contribute up to 3650 in 2022 7300 for families plus an additional 1000 in catch-up contributions if youre 55 or older. Average 401k Balance at Age 55-64 586486. If you are over the age of 50 then you are allowed a 25000 catch up contribution.

Your money will grow with interest as it sits in the retirement account. An employee contribution of for An employer contribution of 20 of your net earnings from self-employment and. If they did amounts would be lower.

This can be achieved simply by entering your beginning balance an aggregated estimate for all contributions yours employer match catch-up an estimate for return on investment and the number of years until retirement then click the Calculate button. To contribute to an HSA you must participate in an eligible high-deductible health care planoften but not always offered through an employer. Specifically you are allowed to make.

You can also pitch in an extra 6500 as a catch-up contributionwhich increases your contribution. Workers age 50 or older can add 6500 in catch-up contributions bringing the total annual contribution to 27000. Like regular 401k contributions catch-up contributions are made through elective salary deferrals not lump sum payments or one-off cash contributions.

Catch-up contributions are 6500 in 2022. Eligible participants may contribute up to double the deferral limit in effect ie. The ending values do not reflect taxes fees or inflation.

2022 There is an alternative limit for governmental 457b participants who are in one of the three full calendar years prior to retirement age. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Make sure that you take advantage of them.

Many 401k plans provide for employer matching contributions to encourage and reward elective deferrals by employees and to maximize employee appreciation of the plan. Cost of Living Calculator Home Sellers Guide. Then your employer will match 100also 2500.

This money grows tax-deferred meaning no taxes are owed on investment earnings until money is withdrawn. A 401k rollover is when you transfer your funds from your old 401k from your previous employer to an individual retirement account IRA or to a new 401k plan set up with your new employer. Up to 41000 in.

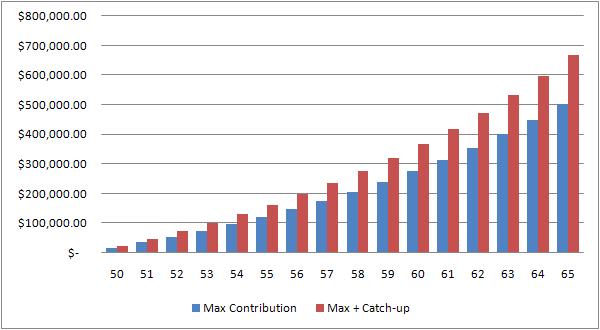

There are two options. Your company might include a dollar for every dollar you put in your 401k plan until you reach a total of 5 of your before-tax pay for the year. 1 5000 annual contributions on January 1 of each year for the age ranges shown 2 an annual rate of return of 7 and 3 no taxes on any earnings within the qualified retirement plan.

The combined limit on employer matching contributions and employee contributions in 2021 is the lower of 58000 or 100 of an employees compensation up to a maximum of 290000 in 2021. The contribution limits and annual catch up contribution allowance vary depending on the type of retirement savings account you own. The employer has the option of depositing matching or profit sharing contributions.

401k Catch-up Contribution Eligibility. However if you are 50 or over and have both an IRA and a 401k you can save an additional 7500. In 2020 Greg is under age 50 so he does not qualify for solo 401k catch-up contributions.

That brings the annual total to 27000 for taxpayers 50 and over. Ohand remember this about the employer match on your 401k. Remember if youre older than 50 and behind on your retirement savings you can make catch-up contributions to max out your Roth IRA at 7000 and your 401k at 27000 in 2022.

A pre-tax 401k is an incredible opportunity to put your hard-earned money to work. These two tax-advantaged retirement plans are designed. This will give you peace of mind as you.

When you roll over the funds all of the funds to a qualifying IRA or 401k account you do not have to pay taxes on the transfer. Roth 401k is a type of retirement savings plan employers offer their employeeswith one big difference.

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Retirement Services 401 K Calculator

How To Catch Up In Your Retirement Savings Plans Equitable

The Ultimate Roth 401 K Guide District Capital Management

Resources To Help You Manage Your 401k Independent 401k Advisors

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Catch Up Contributions How Do They Work Principal

How Much Can I Contribute To My Self Employed 401k Plan

401 K Calculator Credit Karma

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Are You Eligible For Catch Up Contributions Generations Wealth